What is spread betting?

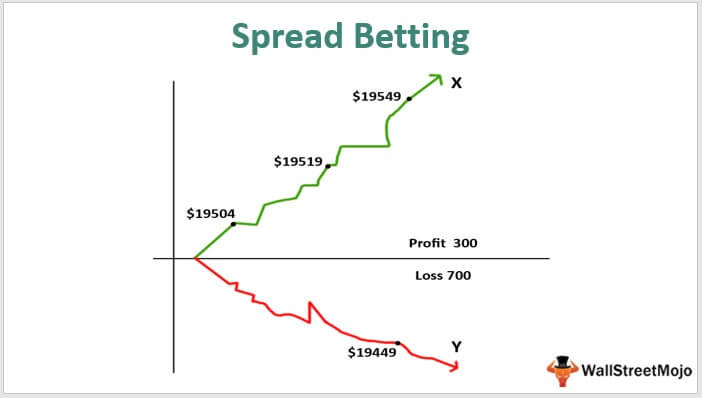

Spread betting is a popular derivative product that allows you to speculate on financial markets like forex, indices, commodities, or shares without owning the underlying asset. Instead, you’d be betting on whether the price will rise or fall.

There are several advantages to spread betting. You can use leverage, which means you don’t have to pay for the entire value of your position; instead, you only need a deposit known as your margin. You can go long or short on thousands of markets, including FX, stocks, indices, commodities, and others. Spread betting is also completely tax-free in the United Kingdom.

Investors align with the bid price if they believe the market will rise and go with the ask if they believe it will fall. Spread betting’s key characteristics include the use of leverage, the ability to go both long and short, the wide range of markets available, and tax advantages.

I’m writing this while dealing with a sensitive head and an empty stomach. I just lost nearly £30,000 spread betting for roughly one hour each day, five days a week. So I figured out how to waste 60 minutes and about £1,500. Overall, that amounts to a piece of money. In the grand scheme of things, it’s not precisely as bad as it seems. Fortunately, I was betting using a few spread betting companies’ demo websites. These are simulations of their live betting locations that let you practice before you start betting with real money. I am aware that I am not a financial genius; if I were, I would have been very wealthy in the past. However, the story of how I managed to lose so much money so quickly does provide a conversation starter: if spread betting seems to be so natural, why do so many people quickly lose all of their money?

Spread betting is increasingly being promoted in putting away and cash the executives distributions. Every week, four or five different spread wagering organizations take full-page variety promotions, dwarfing any other kind of advertising. Spread wagering advertisements are already common in the business sections of many Sunday papers and will most likely begin to appear in individual accounting sections soon. Spread betting may appear to be deceptive to many savers. All things considered, cash in a bank, offers, or unit trusts will provide us with a pitiful 5% a year prior to burden. However, a reasonable surge in demand for spread betting can easily allow you to pocket 10% per week – 500% per year – completely and superbly tax-free. So spread betting can enable you to achieve in a single year what most other ventures would take 100 years or more to achieve.

Spread bettors speculate on the price movements of anything from individual offers, monetary standards, and products to entire business sectors such as the FTSE, Dax, or S&P. Spread betting is so named because the organization providing the service makes the majority of their money by putting an extra spread around the price at which something is traded.

Spread betting appears to have many advantages over traditional financial planning:

You don’t have to buy anything – It allows you to speculate on price movements without having to buy the basic resources – offers, wares, or unfamiliar trade.

It is tax-free – When you trade stocks, receive compensated profits, or receive revenue from a bank, you must pay fees such as stamp duty, capital increases, and personal expenses. Except if spread betting is your regular job and only source of income, there are no taxes to pay when gambling is considered.

You can go long or short – When you spread bet, you can acquire the same amount regardless of whether costs rise or fall, allowing you to accurately predict the bearing. With most types of speculation, you want the price to rise before you make a profit.

You can bet on a rise and a fall at the same time – For example, if the FTSE is trading at 5551-5552, you can place two bets, one on a rise and one on a fall. These may be triggered when the FTSE moves significantly. So, if it starts to rise, your bet that it will rise is activated. Assuming it falls, only your bet that it will fall is activated. As a result, it may appear that you will win no matter what.

Extreme influence – If you wager £50 a pip (a pip is normally the base cost development you can wager on), you can easily win four or multiple times your original bet if the cost moves in the correct bearing. You can win a lot more on a great bet.

You can sit tight for the breakout – Prices on many offers, monetary forms, items, and other things that people bet on will frequently experience times of strength followed by eruptions of development up or down, which spread-betters refer to as ‘the breakout.’ You can place a bet that will be executed if the breakout occurs.

Limits on losses – You can include conditions in your bet that prevent your losses from exceeding your chosen level if your bet is incorrectly placed.

You can change your mind mid-flight – Most wagers, such as horse racing or roulette, require you to stand by weakly once the race has begun or the croupier has called ‘no more wagers’ so that the outcome can determine whether you’ve won or not. Spread betting allows you to close your bet whenever you want. So assuming you’re ahead, you can take your rewards; in the event that you’re behind you can either pick up and move on or stand by with the expectation that things will change and you’ll be up in the future.

Given the variety of properties of spread betting, it should be relatively simple to make a decent chunk of money without much effort. If only by a stroke of luck.

According to industry estimates, roughly 90% of spread-betters lose most or all of their money and close their accounts within 90 days of starting. Another eight percent or so appear to bring in reasonable amounts of cash on a consistent basis, and around two percent of spread-betters make fortunes. I’ve been to a couple of introductions to spread betting organizations, and at one of them, the sales rep revealed that more than 80% of his clients lost money. Even many experts lose on approximately six out of every ten bets. Regardless, they can build their wealth by controlling their misfortunes and expanding their profits when they win.